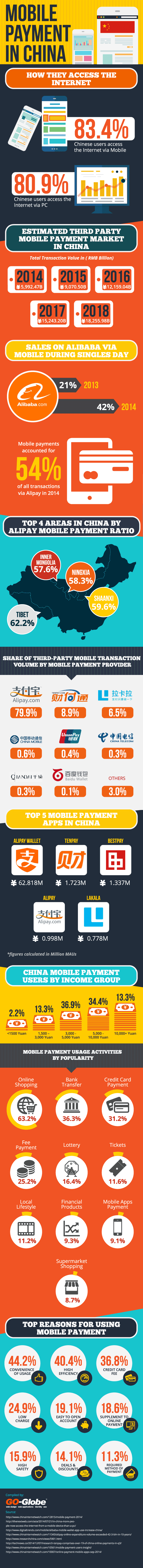

China has transformed into a cashless society, with mobile payments dominating daily transactions across the country. Over the past decade, the rise of mobile payment in China has reshaped the financial landscape, making digital wallets an essential part of everyday life. Consumers prefer fast and secure transactions through platforms like Alipay, WeChat Pay, and China Telecom Bestpay, which now account for the majority of retail and online payments.

The rapid expansion of mobile payments China is driven by the increasing adoption of QR code payments, NFC technology, and contactless transactions. With the Chinese government supporting fintech innovation and digital payment infrastructure, the China mobile payment market continues to experience exponential growth. The introduction of digital RMB (e-CNY) further reinforces China’s position as a global leader in financial technology.

In this article, we will explore key China mobile payment statistics, market trends, and innovations shaping the future of Chinese mobile payment apps. From the market dominance of Alipay and WeChat Pay to the growing use of mobile payment in China for foreigners, we’ll provide insights into how the China digital payment ecosystem is evolving in 2025.

Infographic by GO Globe Singapore

Contents

- 1 2. Mobile Payment Statistics in China: A Market Overview

- 2 3. Leading Mobile Payment Apps in China

- 2.1 Alipay: Market Share, Transaction Volume, and Growth

- 2.2 Alipay Market Share in China

- 2.3 Alipay’s Role in Mobile Finance and Digital Transactions

- 2.4 Alipay for Foreigners in China

- 2.5 WeChat Pay: The Power of Tencent’s Super App

- 2.6 WeChat Pay Market Share and Growth

- 2.7 WeChat Pay’s Role in China’s Digital Economy

- 2.8 Using WeChat Pay as a Foreigner

- 2.9 China Telecom Bestpay and Other Emerging Payment Platforms

- 2.10 China Telecom Bestpay

- 2.11 Other Alternative Payment Solutions

- 3 Foreigners and Mobile Payment in China: A Guide to Cashless Transactions

- 4 5. Future of Mobile Payments in China: Trends and Innovations

- 5 6. China’s Global Influence on Digital Payments

2. Mobile Payment Statistics in China: A Market Overview

The China mobile payment market share is dominated by two major players—Alipay and WeChat Pay. Together, they control over 90% of mobile payment transactions, making them the preferred payment methods for millions of consumers and businesses.

According to recent mobile payment statistics, the total transaction volume in China surpassed $80 trillion in 2024, with projections indicating continued growth. Alipay market share in China remains the highest, with WeChat Pay following closely behind. Meanwhile, platforms like China Telecom Bestpay, JD Pay, and UnionPay QuickPass are also expanding their presence in the China mobile payment market.

The rise of contactless payments in China has fueled this growth, with more businesses integrating QR code payments and NFC technology into their systems. Additionally, the demand for mobile finance adoption in China has increased, with digital wallets offering seamless access to loans, investments, and insurance services.

Key factors driving China mobile payments market growth:

- Expansion of e-commerce and online mobile shopping

- Increased smartphone penetration and digital banking adoption

- Integration of AI and blockchain in fintech solutions

- The rise of cross-border payments through mobile wallets

As digital transactions become the norm, China’s fintech statistics indicate that cash usage is at an all-time low, reinforcing the country’s transition to a completely cashless economy.

Key Mobile Payment Trends and User Adoption

China’s mobile payment ecosystem continues to evolve, with new mobile commerce trends shaping the way consumers and businesses interact with financial services. The increasing integration of AI-powered payment solutions and biometric authentication has enhanced security, making digital transactions safer and more efficient.

Some of the most notable trends in Chinese mobile payment adoption include:

- The rise of super apps: Platforms like WeChat Pay and Alipay are evolving beyond payment solutions, offering a complete ecosystem for shopping, financial services, and social engagement.

- Cross-border e-commerce payments: With China’s dominance in global trade, the demand for international mobile transactions continues to grow. Companies like Alipay and UnionPay are expanding their services to foreign merchants.

- Mobile payment in China for foreigners: More digital wallets are adapting to allow tourists and expatriates to use Alipay and WeChat Pay without a Chinese bank account.

- Government-backed digital currency: The digital yuan (e-CNY) is gaining traction, aiming to provide a state-backed alternative to private mobile payment platforms.

As China’s digital economy continues to flourish, mobile payments in China are expected to further integrate with AI, blockchain, and 5G-enabled smart payments, revolutionizing the way financial transactions are conducted.

3. Leading Mobile Payment Apps in China

As one of the dominant players in the China mobile payment market, Alipay continues to hold a significant share of digital transactions. Operated by Ant Group, Alipay serves over 1.3 billion users worldwide, making it the most widely used Chinese mobile payment app.

- Alipay controls nearly 55% of the China mobile payment market share, with billions of transactions processed daily.

- The platform is deeply integrated with China’s online mobile shopping ecosystem, supporting major e-commerce platforms like Taobao and Tmall.

- Alipay transaction volume reached record highs in 2024, driven by increased consumer spending and cross-border e-commerce.

Alipay’s Role in Mobile Finance and Digital Transactions

Beyond traditional mobile payments in China, Alipay offers a range of financial services, including:

- Wealth management: Users can invest in Yu’e Bao, one of the largest money market funds.

- Micro-loans and credit services: Alipay’s Huabei and Jiebei allow users to make purchases on credit.

- Cross-border payments: Alipay supports international transactions, enabling users to shop from global retailers.

Alipay for Foreigners in China

For foreign visitors and expatriates, Alipay has introduced options to link international bank cards and use Alipay without a Chinese bank account. This move has made mobile payment in China for foreigners more accessible, eliminating the need for cash or local banking services.

WeChat Pay: The Power of Tencent’s Super App

WeChat Pay, operated by Tencent, is another major player in the China mobile payment market, seamlessly integrated into the WeChat ecosystem. With over 1.2 billion monthly active users, WeChat Pay has become an essential tool for both personal and business transactions.

- WeChat Pay vs. Alipay: While Alipay dominates e-commerce, WeChat Pay excels in social payments and offline transactions.

- QR code payments in China: WeChat Pay popularized QR-based mobile payments, making it the default payment method for restaurants, taxis, and street vendors.

- Mobile finance adoption in China: WeChat Pay integrates with WeBank, offering users loans, investments, and insurance services.

WeChat Pay’s Role in China’s Digital Economy

- Seamless integration with WeChat: Users can send money, pay bills, and make purchases directly within the app.

- Business and merchant solutions: WeChat Pay provides tools for small businesses, e-commerce sellers, and international merchants to accept payments.

- Expansion into global markets: Tencent is actively pushing WeChat Pay’s international adoption, allowing Chinese travelers to use the platform abroad.

Using WeChat Pay as a Foreigner

- Foreigners can now link their international credit cards to WeChat Pay, making it easier to make purchases in China.

- The digital RMB (e-CNY) is also being integrated into WeChat Pay, further expanding options for non-Chinese residents.

China Telecom Bestpay and Other Emerging Payment Platforms

While Alipay and WeChat Pay dominate the market, other players like China Telecom Bestpay and JD Pay are gaining traction in the China mobile payment ecosystem.

China Telecom Bestpay

- Operated by China Telecom, Bestpay is expanding its presence by integrating with 5G and AI-powered financial services.

- Bestpay offers secure online and offline payments, targeting telecom users, businesses, and government transactions.

Other Alternative Payment Solutions

- UnionPay QuickPass: China’s state-backed payment system, supporting NFC payments in China.

- JD Pay: Owned by JD.com, JD Pay is growing as a preferred payment option for e-commerce transactions and logistics services.

As China’s fintech industry continues to expand, more mobile payment providers are emerging, diversifying the digital payment landscape and offering consumers more choices beyond the major players.

Foreigners and Mobile Payment in China: A Guide to Cashless Transactions

How to Use Mobile Payment in China as a Foreigner

With China becoming a cashless society, many foreign tourists, students, and expatriates struggle to navigate the mobile payment landscape. Traditionally, using Alipay or WeChat Pay required a Chinese bank account, but recent developments have made it easier for foreigners to access these platforms.

Steps to Set Up Mobile Payment as a Foreigner

- Download Alipay or WeChat Pay and register an account.

- Link an international credit or debit card from providers like Visa, Mastercard, or UnionPay.

- Verify identity using passport details to comply with China’s financial regulations.

- Top-up the wallet balance (if required) for seamless transactions.

- Use QR codes to pay at stores, restaurants, and transportation services.

Challenges and Solutions

- Not all merchants accept foreign-linked accounts: Some smaller vendors may still require a local banking connection.

- Limits on international card payments: Users may face restrictions on transaction limits and currency conversion fees.

- Alternatives like digital RMB: The Chinese government is promoting the digital yuan (e-CNY) as a state-backed alternative for both locals and foreigners.

The Role of Digital RMB (e-CNY) in International Transactions

The introduction of China’s digital yuan (e-CNY) is reshaping the global mobile payment market. Unlike Alipay and WeChat Pay, which are private platforms, e-CNY is a government-issued digital currency designed to complement the existing mobile payment ecosystem.

How e-CNY Works

- Issued and controlled by China’s central bank (PBOC), ensuring security and stability.

- Works independently of Alipay and WeChat Pay, but can be used on both platforms.

- Foreigners can use e-CNY without a local bank account, making it a viable payment option for tourists.

Global Impact of China’s Digital Currency

- Cross-border e-commerce payments: The digital yuan is being tested for international trade and transactions.

- Competition with other digital currencies: China is leading the race for central bank digital currencies (CBDCs).

- Integration with global businesses: Companies like JD.com and McDonald's China now accept e-CNY payments.

The rise of e-CNY and other Chinese fintech innovations highlights the country’s efforts to solidify its position as a leader in digital payments.

5. Future of Mobile Payments in China: Trends and Innovations

AI, Blockchain, and the Next Generation of Digital Transactions

China’s mobile payment market is evolving beyond simple QR code transactions, integrating AI, blockchain, and biometric authentication to enhance security and user experience.

AI-Powered Payment Solutions

- Fraud detection and security: AI is improving transaction security, detecting fraudulent activities in real time.

- Personalized financial services: AI-driven analytics help Alipay and WeChat Pay offer tailored loan, investment, and credit recommendations.

- Chatbot-enabled transactions: Voice-activated payments and AI assistants are making digital finance more accessible.

Blockchain and Smart Contracts

- China’s People’s Bank of China (PBOC) is leveraging blockchain technology to enhance transparency in financial transactions.

- Smart contracts on blockchain platforms ensure secure and automated payments, especially for B2B and cross-border trade.

Biometric Authentication and Contactless Payments

- Facial recognition payments are widely used in retail stores, restaurants, and transportation services.

- Palm recognition and fingerprint scanning are emerging as alternatives to traditional mobile wallet authentication.

These innovations are shaping the future of mobile payments in China, making digital transactions faster, safer, and more integrated into daily life.

The Role of 5G in Enhancing Mobile Payments

China is at the forefront of 5G deployment, and its impact on mobile payments is transformative.

How 5G is Revolutionizing Mobile Transactions

- Instant transactions: Faster network speeds reduce payment processing time, enhancing customer experience.

- Edge computing for better security: Real-time data processing on edge servers reduces the risk of fraud.

- Enhanced IoT payment systems: 5G enables seamless machine-to-machine payments, supporting smart city infrastructures.

From smart vending machines to self-checkout supermarkets, 5G-enabled contactless payments are revolutionizing China’s retail sector.

6. China’s Global Influence on Digital Payments

The Expansion of Chinese Mobile Payment Systems Worldwide

Chinese fintech giants are rapidly expanding their payment services into international markets, influencing global digital finance trends.

Key Expansion Strategies

- Alipay and WeChat Pay are now accepted in over 60 countries, targeting Chinese tourists and businesses.

- Partnerships with global merchants: Major retailers in Europe, the U.S., and Southeast Asia now support China mobile payments.

- Cross-border e-commerce solutions: Platforms like Alibaba and JD.com facilitate seamless international transactions.

Mobile Payment Growth in Hong Kong and Southeast Asia

- Hong Kong mobile payment market share is growing, with increased adoption of AlipayHK and WeChat Pay HK.

- In Southeast Asia, Chinese payment apps are partnering with local fintech startups to capture market share.

Challenges and Regulatory Developments in China’s Digital Payment Market

Regulatory Challenges

- China’s tightening fintech regulations: The government has introduced data privacy laws and anti-monopoly policies affecting Alipay and WeChat Pay.

- Cybersecurity concerns: Stricter rules are in place to prevent financial fraud and protect user data.

- Cross-border compliance: Expanding payment systems abroad requires adapting to international regulations.

The Future of Digital Finance in China

Despite regulatory challenges, China remains the global leader in mobile payments, continuously innovating and setting new benchmarks in the digital economy.