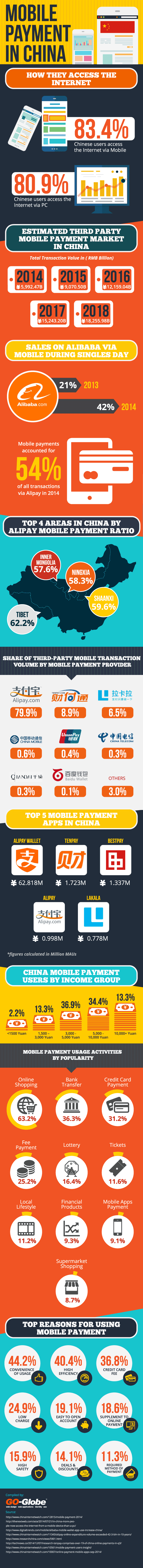

Did you know 83.4% of Chinese online users access Internet from their mobile devices as compared to 80.9% of Internet users who access Internet from PCs. The third party mobile payment mark in China is estimated to reach 18,255.98 RMB Billion by 2018. Mobile devices accounted for 42% of Alibaba sales on Singles Day in 2014 as compared to 21% in 2013. 54% of all transactions via Alipay in 2014 came from Mobile devices. Check out our infographic on "Mobile Payment in China" for more interesting facts and statistics.

Infographic by GO Globe Singapore

To Publish this Image on your Blog or Website . Copy this code

Estimated Third Party Mobile Payment Market in China

| Year | Total Transaction Value in ( RMB Billion) |

| 2014 | 5,992.47 |

| 2015 | 9,070.50 |

| 2016 | 12,159.04 |

| 2017 | 15,243.20 |

| 2018 | 18,255.98 |

Top 4 areas in China by Alipay mobile payment ratio

| Area | Mobile Payment Ratio |

| Tibet | 62.2% |

| Shaanxi | 59.6% |

| Ningxia | 58.3% |

| Inner Mongolia | 57.6% |

Share of third-party mobile transaction volume by Mobile payment provider

| Mobile Payment Provider | %age |

| Alipay | 79.9% |

| Tenpay | 8.9% |

| Lakala | 6.5% |

| China Mobile | 0.6% |

| UMP | 0.4% |

| China Telecom | 0.3% |

| Qiandai | 0.3% |

| Baidu Wallet | 0.1% |

| Others | 3.0% |

Top 5 Mobile Payment Apps in China

| Mobile App | Million MAUs |

| Alipay Wallet | 62.818 |

| Tenpay | 1.723 |

| Bestpay | 1.337 |

| Alipay | 0.998 |

| Lakala | 0.778 |

China Mobile Payment Users by Income Group

| Income Group | %age |

| Less than 1,500 Yuan | 2.2% |

| 1,500 – 3,000 Yuan | 13.3% |

| 3,000-5,000 Yuan | 36.9% |

| 5,000-10,000 Yuan | 34.3% |

| 10,000 Yuan+ | 13.3% |

Mobile payment usage activities by Popularity (Note – Source from 2013)

| Usage Activity | %age |

| Online Shopping | 63.2% |

| Bank Transfer | 36.3% |

| Credit Card Payment | 31.2% |

| Fee Payment | 25.2% |

| Lottery | 16.4% |

| Tickets | 11.6% |

| Local Lifestyle | 11.2% |

| Financial Products | 9.3% |

| Mobile Apps Payment | 9.1% |

| Super Market Shopping | 8.7% |

Top Reasons for Using Mobile Payment ( Note – Source from 2013)

| Reason | %age |

| Convenience of Usage | 44.2% |

| High Efficiency | 40.4% |

| Credit Card Free | 36.8% |

| Low Charge | 24.9% |

| Easy to Open account | 19.1% |

| Supplement to online payment | 18.6% |

| High safety | 15.9% |

| Deals and Discounts | 14.1% |

| Required method of payment | 11.3% |