When you’re choosing a finance ERP system in the UK, you need more than software — you need a proven partner who understands the daily work of your finance team. At GO‑Globe, we help companies like yours take control of their accounting, reporting, and cash flow with an ERP finance module in the UK that fits real business processes.

A best finance ERP UK setup should simplify the way you manage ledgers, budgets, and transactions. Our solutions make it easy to access accurate financial data and stay on top of tax compliance, all without overcomplicated tools or hidden fees. Whether you want help choosing the right finance ERP or need a team to implement and support it, GO‑Globe is here to make sure you get the most from your investment.

By choosing GO‑Globe for your finance ERP system in the UK, you gain a consultant who knows the pitfalls and shortcuts. That way, you spend less time wrestling with software and more time making sound decisions for your business.

When you’re looking for the best ERP for finance UK, you want software that makes your job easier — whether that’s getting reports faster, reducing manual entries, or keeping all your accounts data in one place. Popular choices like Microsoft Dynamics 365, NetSuite, and SAP have earned their spots for a reason.

At GO-Globe, we help you look beyond the big names to the right fit for your business. Our consultants listen to what your team needs and help you pick the best finance ERP UK that matches your goals. Whether you choose one of these leading systems or prefer a more tailored setup, we make sure you implement a solution that truly supports your finance team, not one that slows them down.

Your finance team deserves a system that feels simple and is built around their daily work. With a core finance module in ERP software UK, you gain the tools to close books faster, track every pound in real time, and reduce manual tasks. GO‑Globe specialises in crafting finance modules in ERP that fit UK companies — so you get exactly what you need without guesswork.

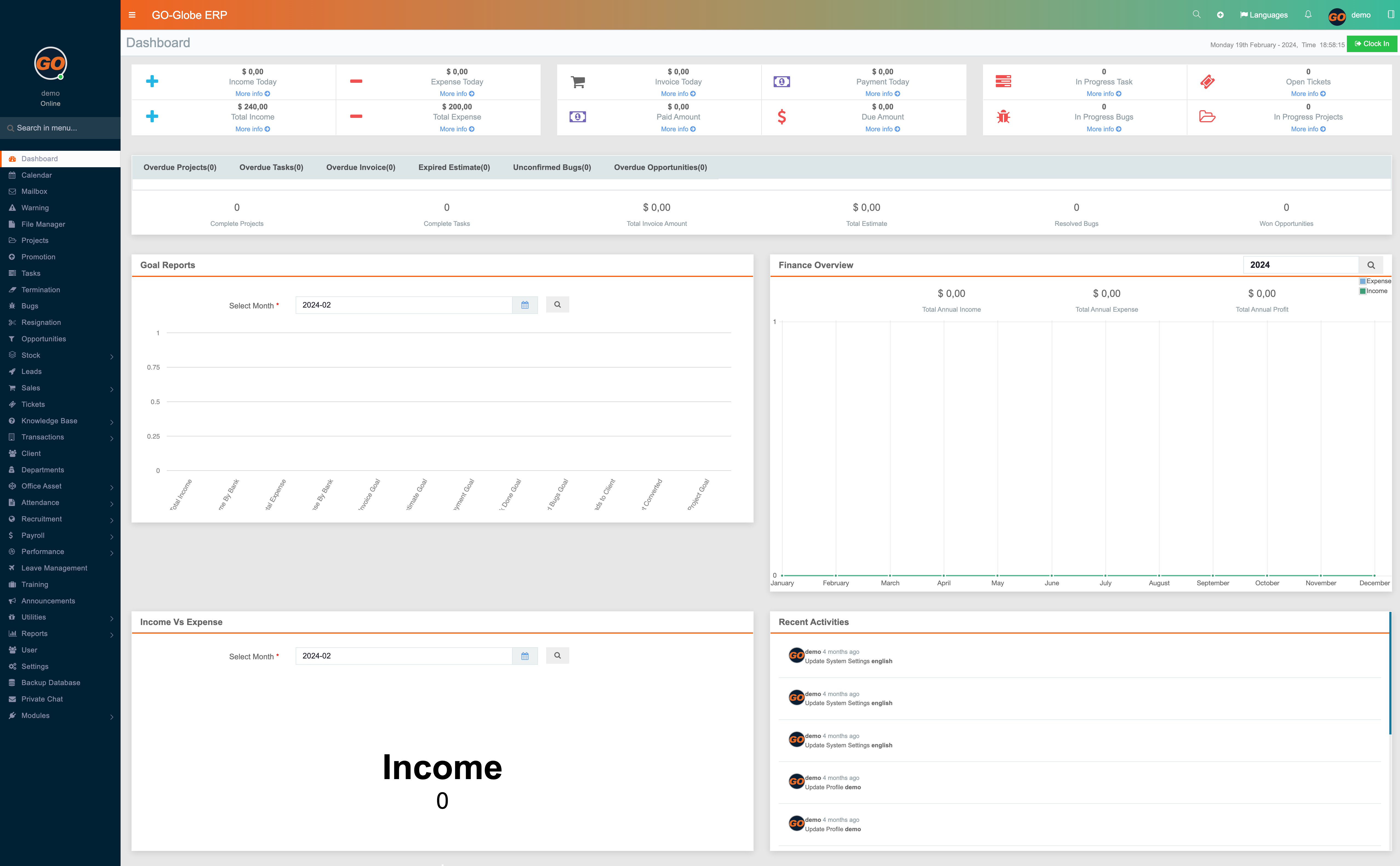

The ERP finance module UK is more than just accounting. It covers every financial touchpoint your business handles. A well-built finance module in ERP links your general ledger (GL) with accounts payable and accounts receivable (AP/AR) so you can see cash flow at a glance. Budgets and reporting tools keep spending on track and give you a clear picture of every decision. GO‑Globe takes these everyday processes and simplifies them. That means fewer errors and more time spent where it counts — making decisions with real data.

For UK businesses that trade across borders or manage several entities, a finance module in ERP UK must do more. With GO‑Globe’s ERP finance module features UK, you can easily report in different currencies, merge financials across companies, and stay up to date with local tax and compliance rules. Our team builds finance modules that help you close the books faster at year-end and handle VAT returns without the usual stress. When your accounting is accurate and up to date, you can plan for growth with confidence, and that’s what this module is all about.

Your business deserves a financial setup that works exactly the way you want. That’s where GO‑Globe’s ERP finance consultant UK team comes in. Whether you’re looking to fine-tune processes or need help with a full rollout, we give you straightforward guidance every step of the way.

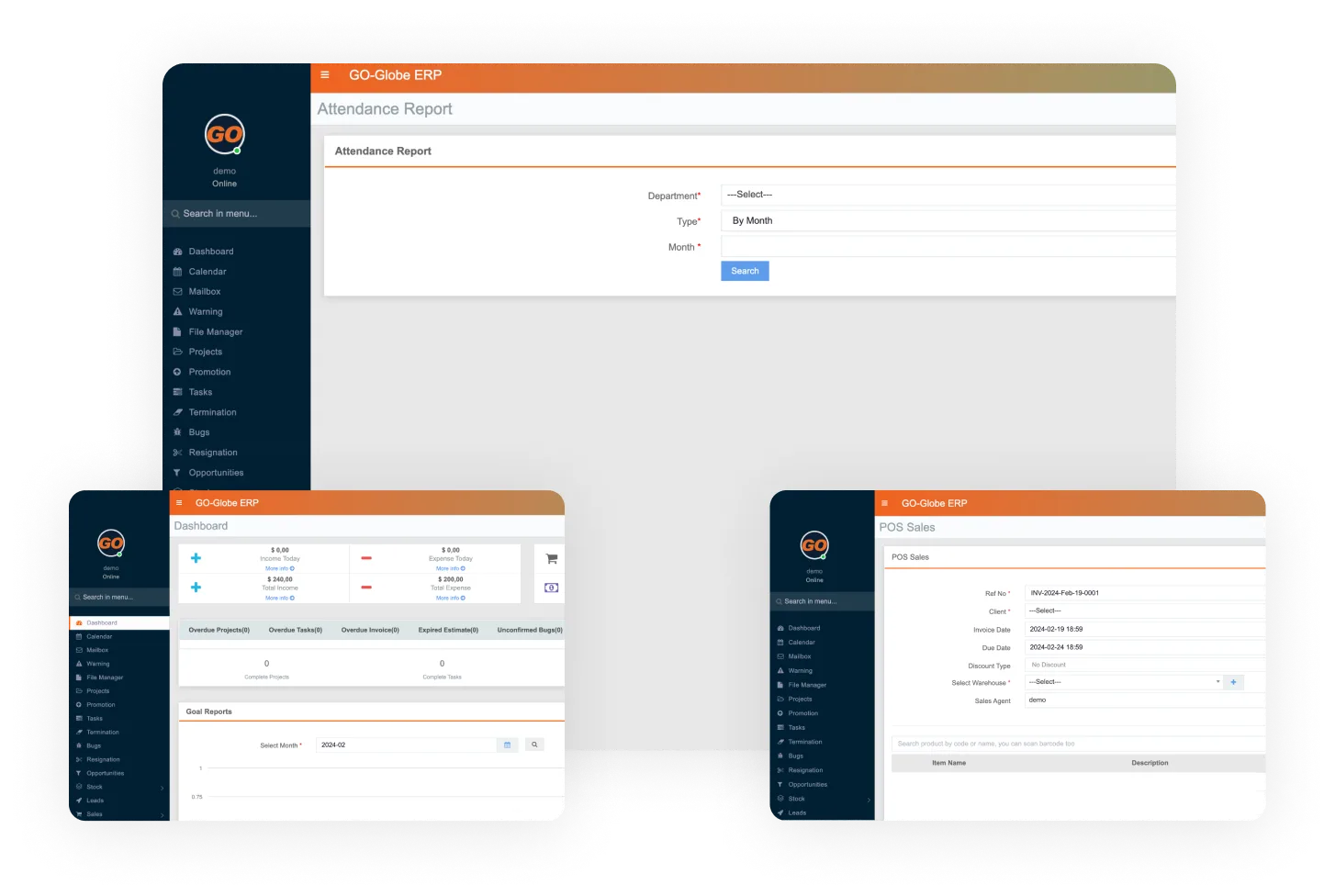

First, we take time to listen. Our consultant ERP finance UK experts review your existing setup and look for the gaps. That means checking the way data flows, how transactions are managed, and what you want to achieve long-term. Once we have a clear picture, we draw up a plan that matches your goals and deadlines. Next, we get hands-on with setup and customisation. From mapping your chart of accounts to fixing reporting headaches, our ERP finance consultant UK specialists make sure the software matches your daily operations. Every adjustment is tested, so you don’t run into surprises after going live.

Finally, we train your team and help you fine-tune as you grow. When you work with GO‑Globe as your finance ERP consultant UK, you’ll have someone to call whenever questions come up. It’s that kind of practical, personal support that keeps your finance team working without a hitch.

You want an ERP that supports your financial processes without delays or surprises. That’s exactly what GO‑Globe aims to deliver. Our finance ERP implementation in the UK is built around a clear process — one that keeps you informed at every stage and focused on results.

First, we take time to scope your goals. Our team listens to your finance team and maps the setup to your business. This ensures your ERP implementation finance the UK matches your reporting requirements, compliance rules, and growth plans.

Next comes the setup. GO‑Globe configures each part of your finance ERP system, so all data, transactions, and accounts connect the way you need them to. Our team tests the system before you go live, fixing any issues early so your rollout stays on track. Your people matter too. That’s why we include hands‑on training that prepares your staff to use the system with confidence. They will know how to use every module — from accounts payable to reporting — without feeling left behind.

And we don’t disappear once it’s up and running. GO‑Globe stays involved with practical support after launch to help you adapt to new requirements, troubleshoot questions, and keep your finance ERP running smoothly in the UK.

If you’re ready to put your finance processes on a solid, proven foundation, let’s talk.

Managing your accounting and finance processes shouldn’t feel like a juggling act. With GO‑Globe’s ERP system accounting and finance UK expertise, you gain a single view of all your numbers—no jumping between tools or waiting on reports.

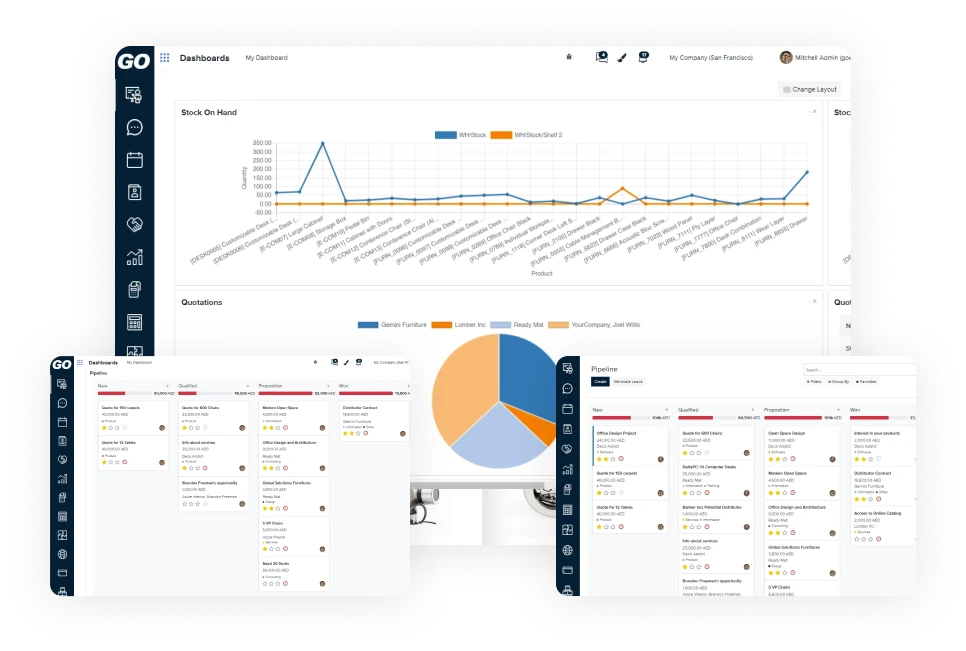

When your accounts and finance teams work from one system, decisions happen faster. GO‑Globe’s ERP system in finance UK simplifies how you track invoices, manage payables and receivables, and close your books at the end of every period. Our solutions bring you real-time visibility into cash flow and financial health. Meaning you can check the status of any account on demand. Every report is updated instantly, so you always have the latest data to guide your choices.

Your team also gets clear, easy-to-read dashboards that highlight what matters most to you, whether that’s spotting overdue invoices or checking budget performance. Plus, we help you close the financial period without errors or delays, keeping everything accurate for audits or compliance.

With GO‑Globe as your partner, your ERP system finance UK stays straightforward and focused on results.

Your company’s financial health depends on accurate data and timely decisions. That’s why finance management in ERP UK is not just an extra feature — it’s a core part of every successful organisation. With a dedicated finance module built into your ERP, you can control cash flow in real time, spot profitable opportunities, and plan with confidence.

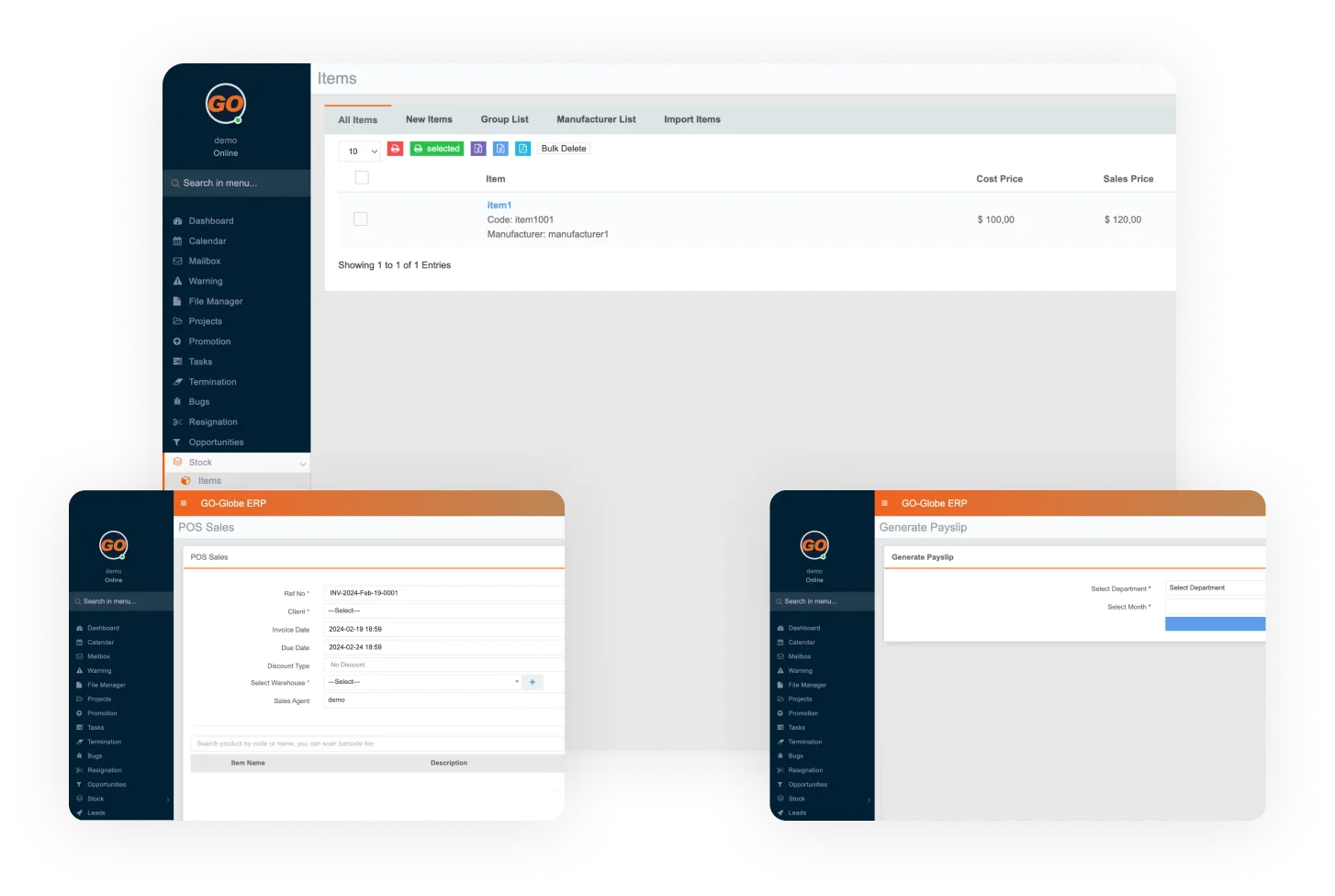

At GO-Globe, we help UK companies set up ERP finance and accounting modules that make everyday tasks easier. Instead of juggling spreadsheets or waiting for reports, you can track income and expenses as they happen. This gives you clear insight into your profit margins, helps you forecast future cash requirements, and ensures you never face surprises at the end of the financial period.

When you choose GO-Globe as your finance ERP consultant UK, we take the time to understand your goals and configure your finance ERP module UK to suit your team. The outcome? Greater financial visibility, smoother cash flow management, and a solid foundation for your business to grow.

When you choose an ERP for finance and accounting, you need more than a checklist. You want to see real features side by side so you can make a confident choice for your team. That’s exactly what we do at GO‑Globe — give you the clear facts so you know what you’re getting.

Below, we’ve compared GO‑Globe with some top names like SAP Business One, Sage X3, and NetSuite. You’ll see exactly which ERP modules finance UK companies tend to need — like payables and receivables management, VAT and tax compliance, multi-currency handling, budgeting tools, and cashflow tracking — and which provider fits those needs.

Your finance team deserves a system that simplifies their work without extra modules they’ll never touch. Take a look at the comparison table to help you make a smarter, quicker decision.

If you manage finances across multiple entities and need clearer control, you need a system built for your challenges. GO‑Globe designs ERP corporate finance UK solutions that grow with your business and simplify your daily work.

With our ERP corporate finance UK setup, you gain one source for all your data, making it easy to see performance across companies, departments, and subsidiaries. This means you close books faster, comply with local regulations, and track every transaction without extra manual steps. Our consultants take the time to understand your structure before recommending the right modules. Whether you need support for multi-entity consolidation, risk management, or financial reporting, GO‑Globe will help you select the tools that suit your team and processes.

If you want a practical ERP corporate finance UK solution backed by hands-on guidance, GO‑Globe is here to help you make it happen.

Your finance team deserves a system that supports the way you work. If you’re looking for an ERP for finance UK that simplifies reporting, cash management, and compliance, you’re in the right place.

At GO‑Globe, we specialise in delivering practical ERP software finance UK solutions that make your processes quicker and clearer. Our team will help you choose and implement a finance ERP module UK that matches your goals and scales with your business. Whether you need help with budgeting tools, VAT reporting, or multi-entity accounting, we’ll make sure every feature is set up properly.

You won’t have to navigate this alone. Our experienced consultants stay with you at every stage — from planning to go-live — so you get a smooth rollout and real results. Ready to see what’s possible for your finance operations? Let’s talk.

Speak to a GO‑Globe ERP Finance Specialist for a free review and demo.

GO-Globe are proud to announce that they have been selected by the SME (Small and medium-sized enterprises) as a finalist. GO-Globe continues to provide Custom Development, E-Commerce, ERP, Extranet, Web portals and other business web tools since 2005. Globe Capital and MEED-Global Data, now in their 8th year stay committed to recognizing and celebrating the most resilient, agile and innovative SME’s in the GCC.

GO-Globe was the 1st portal developer who developed in 2005 number of web portals including the 1st Real Estate portal in the Middle East (GO-Estates, GO-Jobs, GO-Gears, GO-Bazaar, etc.)

GO-Globe has been named the user interface design agency of the November 2019 by TDA - one of the leading authority sites for digital marketing and is trusted by decision-makers around the world.

GO-Globe Web Design Dubai is proud to announce that one of our web designs won an award at the Arabian Property Awards 2014. We won the “Best Real Estate Agency Qatar” for our client website MD Properties at the awards which are sponsored by Rolls-Royce. This served as an inspiring holiday present for our creative and talented Web Design team.

When you choose GO‑Globe for your Finance ERP implementation, you gain much more than just software. You get an experienced partner who knows the UK finance landscape and its compliance requirements. Our ERP finance module UK simplifies your VAT reporting, payment processing, and month-end close so you can focus on what matters most — making informed decisions. Plus, we help you reduce manual tasks and errors, so your team can save hours every week. Every feature is designed with local tax rules and business practices in mind, so you can implement it with confidence and see results fast.

Every Finance ERP implementation is different, and at GO‑Globe, we respect your timelines. Typically, our Finance ERP implementation UK takes between 8 to 16 weeks, depending on the size of your team and the complexity of your processes. Our consultants plan each stage carefully so you never face surprises. From data migration to user training, we follow a proven path that limits disruption. Throughout the process, we give you regular updates, respond quickly to questions, and ensure your team feels ready to go live. Our focus is on a smooth, on-time, on-budget implementation with long-term success in mind.

Yes — many of our clients come to us looking to improve their current systems. Whether you already have ERP finance and accounting modules UK or need to upgrade to new tools, we can help you optimise them. Our consultants will assess your setup, identify gaps, and recommend enhancements so your system works harder for you. That could mean unlocking new reporting features, training your team on under-used tools, or customising existing processes. Our goal is to make sure you’re not paying for features you don’t use and that you have accurate, real-time data to manage your finances efficiently.

After go-live, our commitment doesn’t stop. GO‑Globe offers hands-on support as part of every ERP finance consultant UK package. That includes a dedicated account manager who understands your setup, a clear support hotline for day-to-day questions, and periodic health checks on your system’s performance. Our team is also on hand to help when tax rules change or new features become available, making sure your finance ERP stays up to date. Our commercial focus is to help you avoid downtime, reduce errors, and make sure your finance team always feels supported, long after your system is up and running.

The short answer is that we focus on your business, not just the software. Our consultants take the time to understand your finance processes before recommending any changes. That way, we deliver an ERP finance module UK and an implementation plan that suits your goals, not some generic template. We also have deep expertise in tax compliance, accounting standards, and UK-specific financial regulations — knowledge that many generalist IT companies lack. That means fewer surprises and better financial insights. When you choose GO‑Globe, you gain a partner who’s as invested in your success as you are.