Introduction

The United Arab Emirates (UAE) is experiencing a significant rise in fintech startups, driven by factors such as government support, a growing tech-savvy population, and a conducive business environment. Fintech, or financial technology, refers to innovative solutions that leverage technology to deliver financial services more efficiently and effectively. This article explores the reasons behind the surge in fintech startups in the UAE and the impact they are having on the country's financial landscape.

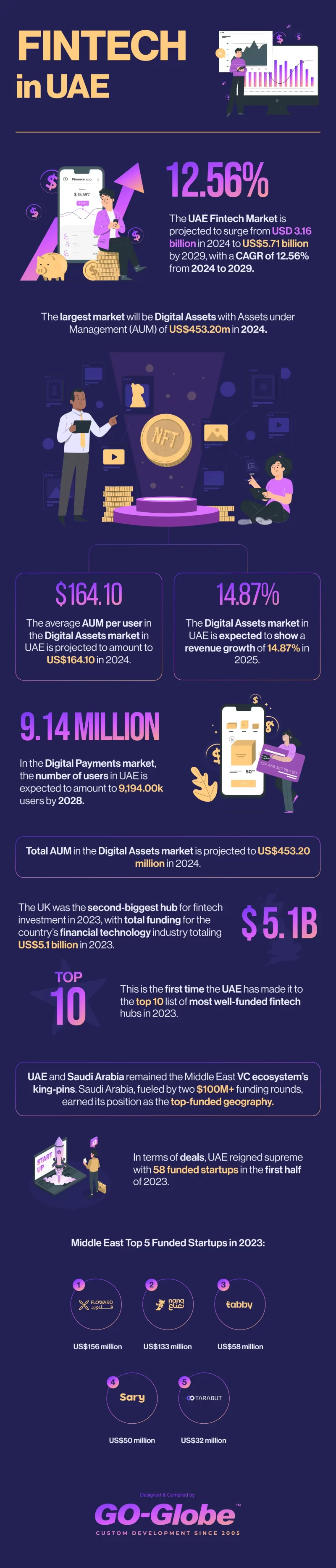

Infographics by GO-Globe UAE

Factors Driving the Rise of Fintech Startups

Government Support and Regulatory Framework

The UAE government has been proactive in supporting the growth of the fintech sector, recognising its potential to drive economic diversification and innovation. Initiatives such as the Dubai Future Accelerators program and the Dubai International Financial Centre (DIFC) Fintech Hive provide startups with access to funding, mentorship, and regulatory support, creating a conducive environment for fintech innovation.

Growing Tech-Savvy Population

The UAE boasts one of the highest smartphone penetration rates globally, with a tech-savvy population eager to embrace digital solutions. This widespread adoption of technology, coupled with high internet penetration and a young, affluent demographic, creates a fertile ground for fintech startups to thrive and disrupt traditional financial services.

Rise of Digital Payments and E-Commerce

The shift towards digital payments and e-commerce in the UAE has created opportunities for fintech startups to innovate in areas such as mobile payments, peer-to-peer lending, and digital wallets. With consumers increasingly seeking convenience and security in their financial transactions, fintech solutions that offer seamless and frictionless experiences are gaining traction.

Strategic Location and Access to Capital

The UAE's strategic location as a gateway between East and West, coupled with its strong financial infrastructure and access to capital, attracts entrepreneurs and investors alike. Fintech startups in the UAE benefit from proximity to major financial institutions, corporate partners, and investment funds, facilitating collaboration and growth.

Impact on the Financial Landscape

Financial Inclusion and Accessibility

Fintech startups in the UAE are addressing gaps in the traditional financial system by offering innovative solutions that improve financial inclusion and accessibility. From digital banking platforms to microfinance services, these startups are reaching underserved segments of the population and providing them with access to essential financial services.

Disruption of Traditional Banking

The rise of fintech startups is challenging traditional banking models in the UAE, forcing established institutions to adapt and innovate. Banks are increasingly partnering with fintech companies to enhance their offerings and improve customer experiences, leading to greater competition and innovation in the financial sector.

Driving Economic Growth and Innovation

Fintech startups are driving economic growth and innovation in the UAE, contributing to job creation, entrepreneurship, and the development of a knowledge-based economy. By fostering a culture of innovation and entrepreneurship, the UAE is positioning itself as a regional hub for fintech innovation and investment.

Challenges and Opportunities Ahead

Regulatory Environment

While the UAE has made significant strides in supporting fintech innovation, challenges remain in navigating the regulatory landscape. Fintech startups must ensure compliance with regulatory requirements while advocating for a regulatory framework that fosters innovation and consumer protection.

Talent Acquisition and Retention

Access to skilled talent is crucial for the success of fintech startups in the UAE. Startups face competition for talent from established financial institutions and technology companies, highlighting the importance of investing in talent development and retention strategies.

Cybersecurity and Data Privacy

As fintech startups handle sensitive financial data, cybersecurity and data privacy are paramount concerns. Ensuring robust cybersecurity measures and compliance with data protection regulations is essential to build trust with customers and safeguard against cyber threats.

Fintech in UAE

- The UAE Fintech Market size in terms of assets under management value is expected to grow from USD 3.16 billion in 2024 to US$5.71 billion by 2029, at a CAGR of 12.56% during the forecast period (2024-2029).

- The largest market will be Digital Assets with Assets under Management (AUM) of US$453.20m in 2024.

- The average AUM per user in the Digital Assets market in UAE is projected to amount to US$164.10 in 2024.

- The Digital Assets market in UAE is expected to show a revenue growth of 14.87% in 2025.

- In the Digital Payments market, the number of users in UAE is expected to amount to 9,194.00k users by 2028.

- Total AUM in the Digital Assets market is projected to US$453.20 million in 2024.

- UAE saw total investment in Fintech soar to 92%.

- The UK was the second-biggest hub for fintech investment in 2023, with total funding for the country’s financial technology industry totaling US$5.1 billion in 2023.

- This is the first time the UAE has made it to the top 10 list of most well-funded fintech hubs in 2023.

- UAE and Saudi Arabia remained the Middle East VC ecosystem’s king-pins. Saudi Arabia, fueled by two $100M+ funding rounds, earned its position as the top-funded geography.

- In terms of deals, UAE reigned supreme with 58 funded startups in the first half of 2023.

- Middle East Top 5 Funded Startups in 2023:

- Floward - US$156 million

- Nana - US$133 million

- Tabby - US$58 million

- Sary - US$50 million

- Tarabut Gateway - US$32 million

Conclusion

The rise of fintech startups in the UAE is poised to transform the country's financial landscape, driving innovation, inclusion, and economic growth. With continued government support, collaboration between industry stakeholders, and a focus on addressing regulatory challenges, the UAE is well-positioned to emerge as a global fintech hub in the years to come.

FAQs

Q1. What is Fintech?

A: Fintech, short for financial technology, refers to the innovative use of technology to deliver financial services in a more efficient, accessible, and user-friendly manner. This includes digital banking, mobile payments, peer-to-peer lending, blockchain, and more.

Q2. Why are fintech startups gaining momentum in the UAE?

A: Fintech startups are gaining momentum in the UAE due to several factors, including the government's support for innovation and entrepreneurship, the country's strategic location as a financial hub, the growing demand for digital financial services among consumers, and the availability of skilled talent and investment capital.

Q3. What are some examples of fintech solutions offered by startups in the UAE?

A: Fintech startups in the UAE offer a wide range of solutions, including digital banking apps, mobile payment platforms, robo-advisors for investment management, peer-to-peer lending platforms, crowdfunding platforms, blockchain-based solutions for remittances and trade finance, and more.

Q4. How do fintech startups contribute to financial inclusion in the UAE?

A: Fintech startups in the UAE are leveraging technology to provide financial services to underserved and unbanked segments of the population, including migrant workers, small businesses, and individuals with limited access to traditional banking services. By offering digital financial solutions that are accessible via smartphones and other devices, fintech startups are helping to bridge the gap and promote financial inclusion.

Q5. What regulatory framework governs fintech startups in the UAE?

A: Fintech startups in the UAE are subject to regulation by various government agencies, including the Central Bank of the UAE (CBUAE) and the Dubai Financial Services Authority (DFSA). These regulatory bodies oversee the licensing, operation, and compliance requirements for fintech firms, ensuring consumer protection, financial stability, and the integrity of the financial system.

Q6. How can individuals and businesses benefit from fintech startups in the UAE?

A: Individuals and businesses in the UAE can benefit from fintech startups by gaining access to innovative financial products and services that are tailored to their needs and preferences. These may include faster and cheaper payment solutions, lower fees for international transfers, simplified lending processes, better investment options, and enhanced financial management tools.

Q7. What are the challenges facing fintech startups in the UAE?

A: While fintech startups in the UAE are experiencing rapid growth and adoption, they also face challenges such as regulatory compliance, cybersecurity threats, competition from traditional financial institutions, access to funding, talent acquisition, and market fragmentation. Overcoming these challenges will be crucial for the long-term success and sustainability of the fintech ecosystem in the UAE.

Q8. How can individuals and businesses support the growth of fintech startups in the UAE?

A: Individuals and businesses in the UAE can support the growth of fintech startups by adopting their products and services, providing feedback for improvement, participating in crowdfunding campaigns, investing in fintech ventures, collaborating with startups on pilot projects, and advocating for supportive policies and regulations that foster innovation and entrepreneurship in the fintech sector.