Abstract

The financial landscape of the United Arab Emirates (UAE) has undergone significant transformations in recent years, propelled by the convergence of traditional banking practices and cutting-edge fintech innovations. This synergy has not only enhanced the accessibility and efficiency of financial services but has also positioned the UAE as a global hub for financial innovation and digital banking solutions.

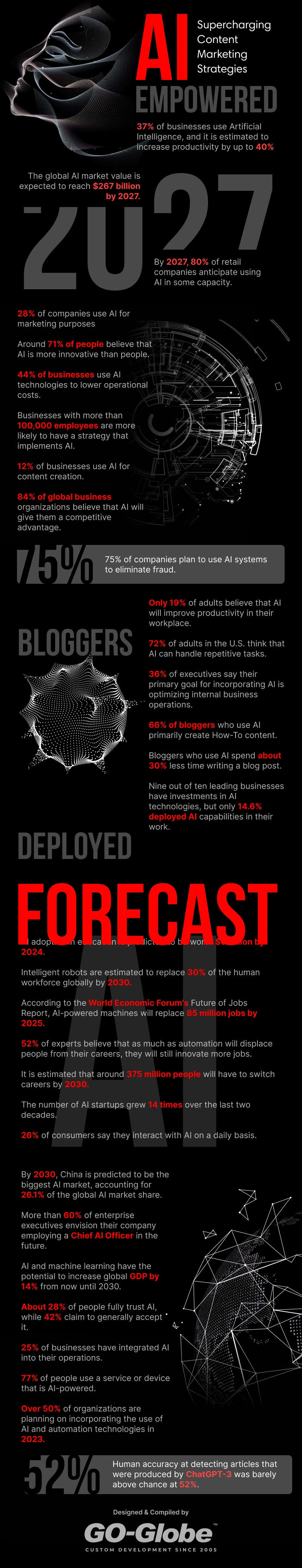

Infographics by GO-Globe UAE

Introduction

The United Arab Emirates (UAE), renowned for its iconic skyline and luxury destinations, is also making waves in the realm of finance. In this article, we delve into the exciting evolution of UAE's financial sector, where traditional banking methods harmoniously coexist with groundbreaking fintech innovations.

Traditional Banking in the UAE

For decades, traditional banking has been the cornerstone of UAE's financial landscape. With a robust network of established banks, residents and businesses have relied on tried-and-true banking services. From personal loans to business financing, traditional banks have played a pivotal role in fostering economic growth.

The Fintech Revolution

Enter the fintech revolution – a disruptive force that is redefining how we approach finance. Fintech, a fusion of "financial technology," encompasses a spectrum of innovative solutions designed to enhance financial activities. Mobile apps, digital platforms, and AI-driven algorithms are reshaping the way we manage money, invest, and make transactions.

Banking and Fin-Tech Innovation and Transformation Sectors

Imagine a world where traditional banking meets futuristic technology. This convergence is the heart of UAE's financial evolution. Fintech startups are collaborating with established banks to create a synergy that offers customers the best of both worlds. Users can enjoy the convenience of digital banking while still benefiting from the expertise and reliability of traditional financial institutions.

Some of the innovation and transformation sector in Banking and FinTech include:

Digital Payments: Transforming Transactions

Gone are the days of cumbersome cash transactions. The rise of digital payments has simplified how we pay for goods and services. Whether it's scanning a QR code or using a mobile wallet, the UAE's financial sector has embraced this change wholeheartedly, making payments swift, secure, and seamless.

Smart Lending: A New Era of Borrowing

Securing a loan can be a daunting task, but fintech has revolutionized the lending landscape. With advanced algorithms and big data analysis, fintech lenders assess creditworthiness more efficiently. This shift has opened doors for individuals and businesses to access funds quickly, propelling entrepreneurial ventures and personal aspirations.

Embracing Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is making waves in the UAE's financial sector. Its decentralized and secure nature is transforming how transactions are recorded and verified. From supply chain management to digital identities, blockchain is enhancing transparency and trust across various industries.

Financial Inclusion: Reaching New Heights

Fintech isn't just about convenience; it's about inclusivity. The UAE's financial sector is making significant strides in reaching underbanked populations. Mobile banking apps and digital wallets are providing individuals who were previously excluded from traditional banking systems with access to financial services, empowering them to save, invest, and plan for the future.

The Role of Regulatory Bodies

In this era of innovation, regulatory bodies play a crucial role in maintaining the integrity of the financial sector. The UAE government and regulatory authorities have established frameworks to ensure that fintech developments align with security standards and protect consumers. Striking the balance between innovation and regulation is key to a sustainable and secure financial landscape.

UAE's Financial Sector: Latest Trends and Statistics

Banking

- The United Arab Emirates has more than 134 financial technology companies that provide employment for 2,000 people.

- Dubai is the regional hub for 80 out of these companies, which is a significant 20% of the total.

- More than 49% of UAE customers prefer purchasing items online after the pandemic.

- Consumers’ preference for digital wallets is increasing, and more than three out of five (61%) utilize them for paying for products and services online instead of cash on delivery.

- Savings Deposits in the banking sector increased by 7.4% on a monthly basis, equivalent to AED18.1 billion, to reach AED263.14 billion at the end of March 2023. This was an increase of 4.7% on an annual basis, equivalent to AED11.8 billion, compared to AED251.33 billion in March 2022.

- Demand Deposits also rose to AED918.95 billion at the end of March 2023, with an annual growth rate of 3.25%. This was an increase of AED28.9 billion, from AED890.02 billion in March 2022.

- According to the Central Bank’s bulletin, Time Deposits reached AED659.63 billion at the end of March 2023. This was an increase of 29.5 percent on an annual basis, equivalent to AED150.1 billion.

- Time Deposits also increased on a monthly basis by 3.45 percent, or AED22 billion, from AED637.61 billion at the end of February 2023. The share of the local currency (dirham) in Time Deposits was 58.8 percent, or AED387.56 billion.

- As per a survey conducted in UAE, 75% of respondents strongly expect contactless payment options to be available on public transportation.

- The popularity of virtual cards is rapidly increasing. Experts predict that the market for these cards will grow to US$60.06 billion by 2030 with a compound annual growth rate of 20.7%.

FinTech

- The UAE Fintech Market is projected to register a CAGR of greater than 15% during the forecast period (2023-2028).

- In the UAE, the market for embedded finance is anticipated to grow 30.1% annually till 2029.

- The largest market is expected to be Digital Investment with a AUM of US$669m in 2023.

- The average AUM per user in the Digital Investment market is projected to amount to US$726.3 in 2023.

- The Digital Assets market is expected to show a revenue growth of 30.7% in 2024.

- In the Digital Payments market, the number of users is expected to amount to 7,903,000 users by 2027.

- Total AUM in the Digital Investment market is projected to US$669m in 2023.

- Decentralized Finance (DeFi's) total market size is growing at 19.03% annual CAGR, reaching US$205.45 million by 2027.

- UAE Fintech Market Leaders:

- Tabby

- YallaCompare

- Beehive

- Sarwa

- Shuaa Capital

Future Prospects and Trends

As we gaze into the future, the UAE's financial sector continues to shine with promise. The marriage of traditional banking and fintech is set to redefine financial interactions. AI-driven customer service, personalized investment strategies, and further advancements in blockchain technology are on the horizon. The UAE is positioning itself as a global leader in finance, where innovation knows no bounds.

Conclusion

The UAE's financial sector has undergone a remarkable transformation, embracing fintech innovations that redefine how banking and financial services are experienced. With a robust regulatory framework, a culture of innovation, and strategic collaborations, the UAE is poised to shape the future of banking and fintech on a global scale. Banking and Fintech Innovations offers a glimpse into the dynamic journey of a nation's financial transformation. The UAE is not only shaping its own economic destiny but also inspiring a global revolution in finance. Embrace this evolution, for the future of finance has never been more promising.

Frequently Asked Questions (FAQs)

Q1: What role does the UAE government play in fostering fintech innovation?

The UAE government actively supports fintech innovation through regulatory initiatives, startup accelerators, and investment incentives.

Q2: How is fintech changing the UAE's banking landscape?

Fintech is revolutionizing UAE's banking by introducing digital payment methods, smart lending, and blockchain technology, enhancing convenience and security.

Q3: What is the significance of the convergence between traditional banking and fintech?

The convergence bridges the gap between traditional banking reliability and fintech's innovation, offering users a seamless and efficient financial experience.

Q4: How does blockchain contribute to financial transparency?

Blockchain ensures transparency by creating an immutable record of transactions, minimizing fraud, and enhancing trust between parties.

Q5: How are AI and RPA revolutionizing traditional banking practices?

AI and RPA are streamlining operations, enhancing customer interactions, and improving risk management in the banking sector.

Q6: Are cryptocurrencies widely accepted in the UAE?

While the UAE is exploring cryptocurrency adoption, it is essential to adhere to local regulations when dealing with cryptocurrencies.

Q7: How does blockchain contribute to financial transparency?

Blockchain ensures transparency by creating an immutable record of transactions, minimizing fraud, and enhancing trust between parties.

Q8: What is green finance, and how is it being promoted in the UAE?

Green finance focuses on environmentally sustainable investments. In the UAE, banks are offering green financial products and supporting eco-friendly initiatives.

Q9: What role do regulatory bodies play in the fintech sector?

Regulatory bodies establish guidelines that promote innovation while safeguarding consumer interests, ensuring a secure and stable financial environment.

Q10: What does the future hold for the UAE's financial sector?

The future of the UAE's financial sector lies in continued innovation, collaboration, and the seamless integration of technology to create a comprehensive and inclusive financial ecosystem.