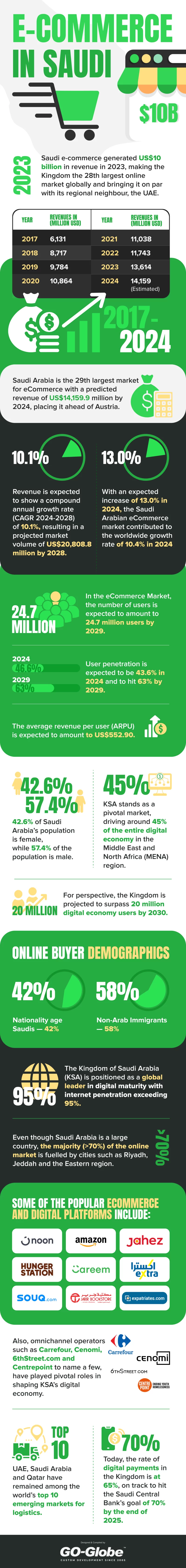

E-commerce in Saudi Arabia is growing and has generated US$10 billion in revenue in 2023, making the Kingdom the 28th largest online market globally and bringing it on par with its regional neighbour, the UAE.

Infographics by GO-Globe E-Commerce Saudi Arabia

Top Statistics for E-Commerce in Saudi Arabia

- Saudi e-commerce generated US$10 billion in revenue in 2023, making the Kingdom the 28th largest online market globally and bringing it on par with its regional neighbour, the UAE.

|

Year

|

Revenues in (million USD)

|

|

2017

|

6,131

|

|

2018

|

8,717

|

|

2019

|

9,784

|

|

2020

|

10,864

|

|

2021

|

11,038

|

|

2022

|

11,743

|

|

2023

|

13,614

|

|

2024

|

14,159 (Estimated)

|

- Saudi Arabia is the 29th largest market for eCommerce with a predicted revenue of US$14,159.9 million by 2024, placing it ahead of Austria.

- Revenue is expected to show a compound annual growth rate (CAGR 2024-2028) of 10.1%, resulting in a projected market volume of US$20,808.8 million by 2028.

- With an expected increase of 13.0% in 2024, the Saudi Arabian eCommerce market contributed to the worldwide growth rate of 10.4% in 2024

- In the eCommerce Market, the number of users is expected to amount to 24.7 million users by 2029.

- User penetration is expected to be 43.6% in 2024 and to hit 63% by 2029.

- The average revenue per user (ARPU) is expected to amount to US$552.90.

- 42.6% of Saudi Arabia’s population is female, while 57.4% of the population is male.

- KSA stands as a pivotal market, driving around 45% of the entire digital economy in the Middle East and North Africa (MENA) region.

- For perspective, the Kingdom is projected to surpass 20 million digital economy users by 2030.

Online Buyer Demographics

|

Nationality

|

%age

|

|

Saudis

|

42%

|

|

Non-Arab Immigrants

|

58%

|

- The Kingdom of Saudi Arabia (KSA) is positioned as a global leader in digital maturity with internet penetration exceeding 95%.

- Even though Saudi Arabia is a large country, the majority (>70%) of the online market is fuelled by cities such as Riyadh, Jeddah and the Eastern region.

- Some of the popular ecommerce and digital platforms include:

- noon

- Amazon

- Jahez

- Hungerstation

- Careem

- eXtra

- Souq.com

- Jarir.com

- Expatriates.com

- Also, omnichannel operators such as Carrefour, Cenomi, 6thStreet.com and Centrepoint to name a few, have played pivotal roles in shaping KSA’s digital economy.

- UAE, Saudi Arabia and Qatar have remained among the world’s top 10 emerging markets for logistics.

- Today, the rate of digital payments in the Kingdom is at 65%, on track to hit the Saudi Central Bank’s goal of 70% by the end of 2025.

E-commerce revenue by category

| Category | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Clothes & Shoes | 1,591 | 1,893.5 | 2188.9 | 2510.7 | 2866.5 | 3209.5 |

| Consumer electronics | 1805.5 | 2,037.6 | 2262.7 | 2487.6 | 2747.2 | 2998.9 |

| Food, cosmetics and Pharmaceuticals | 409.8 | 472.2 | 542.1 | 615.3 | 693.1 | 776.8 |

| Furniture & Home Appliances | 669.9 | 808.1 | 952 | 1112.9 | 1284.4 | 1477.5 |

| Special Interest | 1,417.8 | 1,604.5 | 1797.4 | 1991 | 2193 | 2401.6 |

E-commerce Users by Age Group in millions

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| 16-24 | 2.077 | 2.303 | 2.529 | 2.753 | 2.978 | 3.188 | 3.377 |

| 25-34 | 4.26 | 4.846 | 5.463 | 6.107 | 6.789 | 7.473 | 8.142 |

| 35-44 | 1.646 | 1.911 | 2.202 | 2.51 | 2.842 | 3.183 | 3.525 |

| 45-54 | 0.411 | 0.501 | 0.608 | 0.731 | 0.876 | 1.04 | 1.223 |

| 55+ | 0.14 | 0.202 | 0.287 | 0.39 | 0.518 | 0.67 | 0.847 |

By Gender

| Year | Men | Women |

| 2014 | 6.166 | 2.369 |

| 2015 | 7.09 | 2.673 |

| 2016 | 8.104 | 2.984 |

| 2017 | 9.188 | 3.302 |

| 2018 | 10.372 | 3.631 |

| 2019 | 11.606 | 3.949 |

| 2020 | 12.867 | 4.247 |