Introduction

In recent years, Saudi Arabia has undergone a remarkable transformation, particularly in its banking and financial technology (FinTech) sectors. The nation's ambitious vision for the future, known as Vision 2030, has set the stage for unprecedented changes, propelling Saudi Arabia into becoming a global economic powerhouse. This has lead to the emergence of new banking services and FinTech solutions, opening up interesting potential for both businesses and consumers. The industry has seen improvements in online loans, mobile payments, and digital banking, increasing public access to and convenience with financial services. In addition, regulatory changes have been made to encourage the expansion of the FinTech ecosystem and draw both domestic and foreign investment. Overall, Saudi Arabia's reform has opened the door for a thriving and dynamic banking and FinTech sector. This article delves into the key aspects of the transformation, highlighting the impressive growth of the banking and FinTech sectors.

Vision 2030: A Catalyst for Change

Saudi Arabia's metamorphosis from an oil-dependent economy to a diversified and tech-savvy nation has been nothing short of impressive. Vision 2030, spearheaded by Crown Prince Mohammed bin Salman, is the guiding force behind this transformation, with the intention of reducing the kingdom's dependence on oil, fostering economic growth, and enhancing the quality of life for its citizens.

Vision 2030 outlines a strategic roadmap that encompasses various sectors, including banking and finance. The aim is to create a robust and competitive financial landscape that supports innovation, attracts foreign investment, and stimulates economic activity. This vision has led to a series of reforms and initiatives that have breathed new life into Saudi Arabia's banking and FinTech domains.

Modernization of Traditional Banking

Incorporating Digital Services

Saudi Arabia's banking sector has embraced digital transformation, offering an array of online services that cater to the needs of tech-savvy consumers. Online banking, mobile applications, and digital wallets have become integral parts of the banking experience, enabling customers to perform transactions, manage accounts, and access information conveniently.

Enhancing Customer Experience

Banks are focusing on enhancing customer experience by leveraging cutting-edge technologies. AI-powered chatbots provide real-time assistance, while personalized financial recommendations are made possible through data analytics. These innovations not only streamline processes but also foster customer loyalty.

Facilitating Financial Inclusion

The transformation extends to rural areas and underserved populations. With a significant portion of the population previously excluded from financial services, digital banking has bridged the gap. Mobile banking has enabled access to banking services, credit, and insurance for previously marginalized individuals and businesses.

Opening a Bank Account Online through Mobile App/Website

Customers can now open a bank account online, without visiting the bank in person. All users have to do is sign up online through the banking applications on phone/website, and fill in their Iqama number, National address, and all necessary personal and professional details, to easily open a bank account within minutes. The hassle of calling the bank to resolve issues, or visiting the bank is gone now. Apart from this, debit cards can be printed from Self-Service kiosks, without involving in the hassle of ordering it to their address, or visiting the bank to receive it. Digital Transformation in the Banking sector has really been huge, and banks are continuously working to enhance their services.

The Rise of FinTech in Saudi Arabia

Saudi Arabia has announced a number of plans to encourage the development of the FinTech sector through the Vision 2030 project. This entails refining the regulatory environment to promote innovation and investment, encouraging collaborations between established financial institutions and FinTech firms, and raising public awareness of financial and technological literacy. The government is also making investments in technology and infrastructure to facilitate the banking sector's digital transformation. By fostering a climate that is suitable for the development and uptake of novel banking and FinTech solutions, these initiatives hope to contribute to Saudi Arabia's economic diversification and expansion.

Fostering Innovation and Entrepreneurship

FinTech startups have flourished in Saudi Arabia's supportive ecosystem. These startups are revolutionizing payment systems, lending practices, investment platforms, and more. The government's initiatives to fund and incubate startups have led to a vibrant ecosystem that encourages innovation and entrepreneurship.

Regulatory Framework for FinTech

To ensure a balanced playing field, regulators have introduced a comprehensive framework for the FinTech sector. This framework ensures consumer protection, cybersecurity, and healthy competition while allowing startups to experiment and thrive.

Disrupting Traditional Financial Services

FinTech is disrupting traditional financial services by offering efficient, cost-effective, and user-friendly alternatives. Peer-to-peer lending, robo-advisors, and digital payment platforms are redefining how individuals and businesses interact with money.

Collaborations between Banks and FinTech Startups

Synergies for Mutual Growth

Collaborations between established banks and innovative FinTech startups are creating win-win scenarios. Banks gain access to cutting-edge technology, while startups benefit from established infrastructures and customer bases.

Advancing Technological Solutions

Partnerships are driving advancements in blockchain, AI, and biometric authentication. These technologies enhance security, streamline operations, and open new avenues for financial services.

Investments in Technological Infrastructure

Cybersecurity and Data Protection

As the digital landscape expands, so do concerns about cybersecurity. Banks and FinTech companies are investing heavily in robust cybersecurity measures and data protection protocols to safeguard sensitive information.

Digital Payment Systems

Digital payment systems are evolving rapidly. Mobile payment apps, QR code-based transactions, and contactless payment methods are becoming the norm, paving the way for a cashless society.

Blockchain Implementation

Blockchain technology is gaining traction in Saudi Arabia's financial sector. Its transparency and security features are being leveraged for efficient cross-border transactions, supply chain finance, and more.

Popular Banks and Fintech Companies in Saudi Arabia

Banks

- Al-Rajhi Bank

- Saudi National Bank (SNB)

- Riyad Bank

- Saudi Awwal Bank (SAB)

- Alinma Bank

FinTech Organizations

- PayTabs

- Tap Payments

- Tamara

- UNIINT

- Wafeer SA

Challenges and Opportunities

Addressing Regulatory Complexities

While regulatory frameworks exist, navigating through complex regulations can be a challenge. Striking the right balance between innovation and compliance is essential for sustainable growth.

Nurturing Local Talent

To drive the transformation forward, nurturing local talent is crucial. Investment in education and skill development ensures a workforce equipped to drive innovation in the banking and FinTech sectors.

Seizing the Potential of Islamic Finance

Saudi Arabia's leadership in Islamic finance presents an opportunity to combine traditional finance principles with modern technology, catering to both local and global markets.

Global Recognition and Competitiveness

To gain global prominence, Saudi Arabia has aimed to attract foreign investments in huge amounts. The Saudi Arabian government has created a number of special economic zones, namely:

- King Abdullah Economic City

- Jazan Economic City

- NEOM

- Qiddiya

These are just a few famous examples. Foreign investors can take advantage of a number of incentives and advantages provided by these zones, including simplified rules, tax exemptions, and access to top-notch infrastructure. They provide a climate that is favorable for businesses to flourish and support Saudi Arabia's economic growth. The transformation has garnered international attention, leading to increased foreign investment in Saudi Arabia's banking and FinTech sectors. The nation's openness to collaboration has enhanced its global competitiveness.

Growth of Banking and FinTech Sector: Facts, Figures and Latest Statistics

Infographics by GO-Globe Saudi Arabia

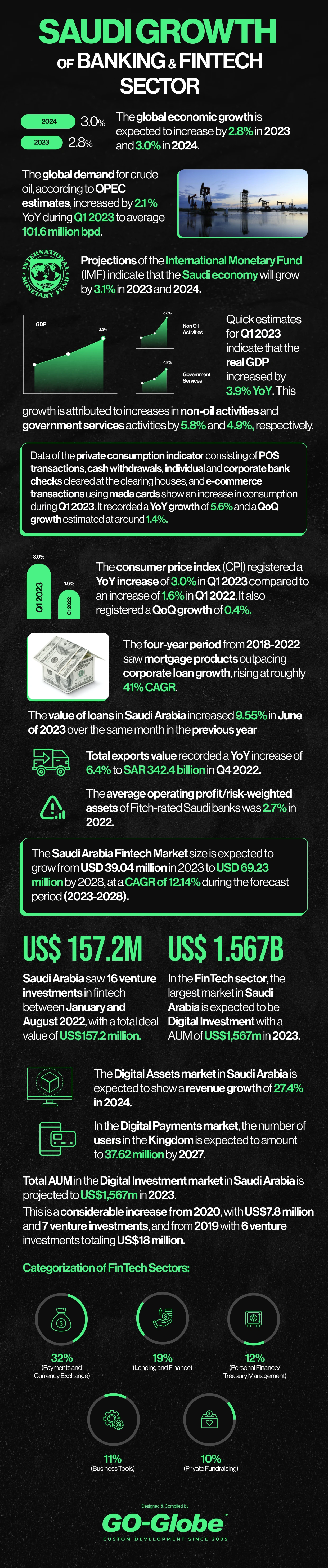

- The global economic growth is expected to increase by 2.8% in 2023 and 3.0% in 2024.

- The global demand for crude oil, according to OPEC estimates, increased by 2.1 % YoY during Q1 2023 to average 101.6 million bpd.

- Projections of the International Monetary Fund (IMF) indicate that the Saudi economy will grow by 3.1% in 2023 and 2024.

- Quick estimates for Q1 2023 indicate that the real GDP increased by 3.9% YoY. This growth is attributed to increases in non-oil activities and government services activities by 5.8% and 4.9%, respectively.

- Data of the private consumption indicator consisting of POS transactions, cash withdrawals, individual and corporate bank checks cleared at the clearing houses, and e-commerce transactions using mada cards show an increase in consumption during Q1 2023. It recorded a YoY growth of 5.6% and a QoQ growth estimated at around 1.4%.

- The consumer price index (CPI) registered a YoY increase of 3.0% in Q1 2023 compared to an increase of 1.6% in Q1 2022. It also registered a QoQ growth of 0.4%.

- The four-year period from 2018-2022 saw mortgage products outpacing corporate loan growth, rising at roughly 41% CAGR.

- The value of loans in Saudi Arabia increased 9.55% in June of 2023 over the same month in the previous year

- Total exports value recorded a YoY increase of 6.4% to SAR 342.4 billion in Q4 2022.

- The average operating profit/risk-weighted assets of Fitch-rated Saudi banks was 2.7% in 2022.

- The Saudi Arabia Fintech Market size is expected to grow from USD 39.04 million in 2023 to USD 69.23 million by 2028, at a CAGR of 12.14% during the forecast period (2023-2028).

- Saudi Arabia saw 16 venture investments in fintech between January and August 2022, with a total deal value of US$157.2 million.

- In the FinTech sector, the largest market in Saudi Arabia is expected to be Digital Investment with a AUM of US$1,567m in 2023.

- The Digital Assets market in Saudi Arabia is expected to show a revenue growth of 27.4% in 2024.

- In the Digital Payments market, the number of users in the Kingdom is expected to amount to 37.62 million by 2027.

- Total AUM in the Digital Investment market in Saudi Arabia is projected to US$1,567m in 2023.

- This is a considerable increase from 2020, with US$7.8 million and 7 venture investments, and from 2019 with 6 venture investments totaling US$18 million.

- Categorization of FinTech Sectors:

- 32% - Payments and Currency Exchange

- 19% - Lending and Finance.

- 12% - Personal Finance/Treasury Management

- 11% - Business Tools

- 10% - Private Fundraising

Conclusion

The transformation of Saudi Arabia's banking and FinTech sectors is a testament to the power of vision, innovation, and collaboration. With Vision 2030 guiding the way, the nation has embraced modernization, fostering an ecosystem where traditional banking and cutting-edge FinTech solutions coexist harmoniously.

Frequently Asked Questions (FAQs)

Q1: How has Vision 2030 impacted Saudi Arabia's banking sector?

A: Vision 2030 has driven significant reforms in Saudi Arabia's banking sector, promoting digitalization, innovation, and financial inclusion.

Q2: What role do FinTech startups play in this transformation?

A: FinTech startups have played a pivotal role by introducing disruptive technologies and solutions that challenge traditional financial practices.

Q3: How is Saudi Arabia addressing cybersecurity concerns in its financial sector?

A: The nation is investing heavily in cybersecurity measures to protect sensitive financial data and ensure the safety of digital transactions.

Q4: What opportunities does Islamic finance offer in the context of FinTech?

A: Islamic finance provides a unique opportunity to merge traditional principles with modern FinTech solutions, catering to a global audience.

Q5: How is Saudi Arabia's transformation influencing the global financial landscape?

A: Saudi Arabia's transformation is positioning the nation as a key player in the global digital economy, contributing to advancements in financial services worldwide.